Under California law, commercial trucks must carry specific insurance policies to safeguard the safety of the truckers and other road users. The regulations on insurance coverage are not only designed to protect companies and drivers, but they also protect the victims impacted by the collisions. Fully comprehending the details surrounding commercial truck policy requirements might help ensure adherence to federal and state laws. This is particularly so if you are the truck owner or accident victim. This blog explains everything you need to know about the insurance requirements for commercial trucks in California.

What Commercial Truck Insurance Means

Commercial truck insurance refers to a policy meant to provide coverage to commercial automobiles. These include trucks utilized for business. The insurance financially protects against liability and physical damage that could originate from truck collisions. Unlike personal automobile insurance policies, the insurance policies for commercial trucks cater particularly to the trucking industry's needs, considering the greater liability and higher risks related to operating large motor vehicles.

Who Requires Commercial Truck Insurance?

California law requires you to have commercial truck insurance if you use or own a truck for commercial reasons. That includes businesses with a truck fleet and single-track contractors, since there is a higher risk of going through costly incidents that could lead to financial loss.

Ensure you have adequate insurance coverage if any of these situations apply to you:

- You are either in charge of operating a commercial truck or you own one

- You use your truck for commercial-related activities

- You can use your truck to transport either passengers or cargo

- You are a trucking contractor

Key Elements of Commercial Truck Insurance Policies

The key components of commercial truck insurance policies are as follows:

Bobtail Insurance Coverage

Bobtail insurance covers the truck when it is operated with no trailer, like when returning from delivering goods. This insurance coverage is crucial for owner-operators who require protection even when their truck is not carrying cargo. It ensures any damages or collisions during these periods are covered, averting out-of-pocket costs for the trucker.

Physical Damage Insurance

Physical damage coverage covers the commercial truck itself. It includes accident insurance that pays for any damages from a crash and comprehensive insurance that covers non-accident incidents such as natural disasters, vandalism, or theft. Trucking companies and owner-operators need physical damage insurance coverage to safeguard their truck investments.

Cargo Insurance

The cargo insurance cover safeguards against damage or loss to merchandise that is in transit. This type of insurance is especially essential for any business transporting sensitive or valuable cargo. Cargo insurance for commercial trucks ensures the load in transit is covered should there be loss, damage, or theft during transit.

Cargo insurance is essential for keeping the trust and business of customers and clients who depend on safe and timely delivery of merchandise. Having enough of it is critical for the operation of commercial trucks.

Liability Insurance Coverage

Every commercial truck in California must have liability insurance coverage. This covers property damage and bodily injury arising from a crash the truck caused. California law requires that commercial trucks have minimum liability insurance coverage. The coverage is critical as it safeguards the trucker and trucking company from substantial financial loss because of medical expenses and legal claims arising from accidents.

Insurance Requirements for California Commercial Trucks

California has particular insurance conditions for commercial trucks to ensure all truck operations in the state are sufficiently covered. These insurance requirements are meant to safeguard trucking companies, owner-operators, and the public in cases of accidents.

Requirements for Minimum Insurance Coverage

California has minimum liability insurance requirements for commercial trucks. These requirements depend on the load being transported and the type of motor vehicles. Trucks transporting hazardous materials, for example, require more significant coverage. That is because of the heightened risk that comes with carrying dangerous cargo. The minimum liability insurance requirements for California commercial trucks are the following:

- $20,000 per vehicle and $20,000 per catastrophe in cargo insurance

- $300,000 for non-dangerous cargo weighing below 10,000 lbs

- Five million U.S. dollars for dangerous materials

- One million U.S. dollars for oil transport

- $750,000 for general cargo

These minimum liability insurance requirements ensure that trucking companies carry adequate coverage to financially protect them and the public. The companies can address damages and collisions with these types of coverage, safeguarding their financial stability and the public. The requirements guarantee that a victim can recover expenses associated with property damage, lost wages, and medical costs in case of a collision. Operators who fail to meet these requirements might face legal consequences and considerable liability.

Insurance Requirements for Interstate Commercial Trucks

Cargo autos operating interstate must follow federal and state insurance rules and regulations. The FMCSA (Federal Motor Carrier Safety Administration) conditions interstate truck insurance. It mandates coverage ranging between $300,000 and $5,000,000 based on the type of freight in transit as follows:

- $5,000,000 when carrying hazardous materials

- $1,000,000 when carrying oil

- $750,000 when carrying non-hazardous cargo in vehicles weighing beyond 10,000 lbs

- $300,000 when carrying non-hazardous cargo in vehicles weighing below 10,000 lbs

Trucks transporting hazardous goods must carry more substantial insurance. The same applies to trucks operating under a higher-risk classification. Considerable coverage is necessary to account for the increased risks related to interstate transportation.

Also, California trucks that operate beyond state lines must adhere to these federal rules. This makes the landscape more intricate for trucking companies operating outside and within the state.

Motor Carrier Permit Requirement

Under California law, truck companies and owners must have a motor carrier permit. Before acquiring this permit, you must first file proof of insurance coverage. The permit is mandatory for operating commercial trucks legally within California. It also ensures the trucking company satisfies all regulatory requirements.

Types of Insurance Coverage for Commercial Trucks

Insurance policies for commercial trucks vary depending on the trucking businesses’ specific needs. Here are the prevalent types of insurance coverage generally included in insurance policies for commercial trucks:

Hazardous Materials Coverage

Commercial trucks transporting dangerous materials require special insurance coverage. That is because of the heightened risks linked to this kind of freight. Hazardous materials insurance coverage provides extra protection in accidents involving dangerous goods, ensuring adherence to state and federal regulations.

Umbrella Insurance

Umbrella insurance offers extra liability coverage above the limits of the main insurance policies. The coverage is advantageous for any trucking company subject to substantial risks and wants to ensure it has adequate protection should major road crashes or lawsuits arise.

Workers' Compensation

Workers’ compensation insurance covers lost wages and medical expenses for employees hurt on the job. The coverage is compulsory under California law. It is essential as it safeguards workers and the trucking company from monetary losses because of workplace injuries.

Motor Truck Cargo Insurance

The motor truck cargo insurance policy covers the freight the truck transports. This insurance safeguards against damage or loss to the cargo and is crucial for trucking companies that haul sensitive or valuable goods. Having enough cargo insurance coverage ensures clients’ merchandise is safeguarded. This can promote the company’s reliability and reputation.

Non-Trucking Liability Insurance

Non-trucking liability insurance provides coverage when the truck is utilized for non-commercial purposes, like personal use. The insurance is crucial for owner-operators who might utilize their truck for personal purposes when it is not under dispatch.

General Liability Insurance

The general liability policy covers various incidents that could happen in a trucking business. These incidents include property damage, legal fees, and bodily injury. This insurance coverage is important for safeguarding the trucking business from liabilities and risks arising during operations.

Filing Truck Accident Insurance Claims

Bringing an insurance claim after an accident with a commercial truck can be difficult. Often, victims must deal with more than one insurer. That is because trucking companies have several policies that cover the driver, cargo, and vehicle. You want to have a skilled attorney helping you bring these claims and ensure you recover the maximum potential compensation.

Usually, insurers may attempt to minimize the insurance payout, subjecting you to uncovered costs associated with the lost wages, long-term rehab, and medical bills. An experienced truck accident attorney can probe the collision vigorously and deal with the insurance companies for you.

Under California law, all truck accident incidents are subject to strict liability standards. That means the trucking company and the trucker are usually responsible for the resulting damages should they fail to satisfy safety standards, including insurance coverage. This makes it simpler for the victims involved to pursue compensation. However, it also necessitates that you comprehend the insurance policies’ particulars.

Filing an insurance claim following a truck collision entails several steps. Trucking businesses and truckers must provide comprehensive crash reports and cooperate with insurers’ investigations. Knowing how the claims process goes can assist in ensuring that your claim is processed efficiently and that you receive compensation promptly. The claims process entails the following:

- Documenting the crash scene

- Collecting witness statements

- Providing medical records if you suffered injuries

Comprehensive documentation assists the insurance provider in assessing the claim appropriately and determining the correct compensation. Prevalent steps in bringing an insurance claim are as follows:

- Reporting the collision. Inform your insurer immediately following the crash.

- Documenting the scene. Capture pictures and collect information from all the involved parties.

- Medical records. Present documentation of any medical treatment you received because of the crash.

- Repair estimates. Look for the estimates for auto repair

- Cooperate with investigators. Coordinate with your insurer during their investigations to ensure

Multiple Insurance Claims

Collisions that involve commercial trucks usually result in multiple insurance claims. That is because of the involvement of different parties. These parties include cargo loaders, trucking companies, truckers, and other drivers. Working with all the involved insurers is crucial. You will ensure they have handled your claim correctly and addressed all liabilities and damages.

Damages a Commercial Truck Insurer Can Award You

After being in a commercial truck accident, you may be eligible to recover compensation from the truck’s insurance company. The compensation you will recover is contingent on the damages you suffered and the accident's severity. Your lawyer will assist you in preparing an insurance settlement demand. The demand explains the losses you incurred due to the truck collision and their worth. Damages fall under two primary categories: economic and non-economic.

Economic damages are also called special damages. They compensate for measurable costs, and assigning a dollar amount to them is easier. They include, without limitation:

- Current, past, and future medical expenses and bills

- Lost income because of the missed work time

- Loss or diminished earning capacity

- Vehicle replacement or repair

- Ongoing occupational, physical, and other rehab therapies

- Out-of-pocket expenses

- Household services

- Skilled nursing and personal care

Non-economic damages are also called general damages. They compensate for intangible losses, to which assigning a dollar amount is challenging. They include, but are not limited to:

- Pain and suffering

- Diminished quality of life

- Loss of enjoyment of life

- Emotional distress

- Loss of companionship

- Disfigurement and scarring

- Mental anguish

- Impairments and disabilities

Based on the case facts, you may also recover punitive damages. These are meant to punish the negligent liable party for their reckless conduct. They are also awarded to deter the liable party's behavior. Judges only award punitive damages in rare cases involving malicious behavior. For example, if the trucker deliberately crashed into your car during a road rage incident, you might recover punitive damages.

And if your loved one died due to a commercial truck accident, you may be eligible to file a wrongful death claim. If you win the case, you will recover wrongful death damages, including:

- Burial expenses

- Funeral costs

- The lost financial support and income the deceased would have provided had they been alive.

- The deceased's pain and suffering

- Loss of companionship and consortium

An experienced lawyer will ensure that the applicable insurance companies consider all the damages and provide adequate compensation.

Dealing With Insurers is Not Easy: Tips You Can Apply

It is good that California commercial trucks must carry extra liability insurance. Should an accident happen, tractor-trailers may cause extensive destruction. Comprehensive liability insurance policies assist in ensuring victims have an avenue to compensation.

That said, insurers that offer liability insurance policies to commercial trucks are aggressive. They know so much is at stake and fight back hard to part with as little compensation as possible. You want to prepare yourself. The following are tips you can apply to deal with trucking insurance after a crash:

- Understand that they are defending your interests. Realizing that the insurance company is not on your side is essential. Their primary aim is to lower their liability, which, in turn, means limiting your payout. Considering your adversarial relationship with the trucking business and its insurance company, approach each interaction carefully. No insurer is looking after your interests.

- Do not give recorded statements. One prevalent tactic insurers use is asking for recorded statements in the initial stages of the claims process. They might paint your statements simply as part of the fact-finding process. Whereas that may appear harmless, it is a strategy meant to pin you down to a version of events before fully comprehending the degree of your damages or injuries. It is common for victims of truck accidents to make a statement that allows their words to be twisted or taken out of context.

- Be cautious of the quick settlement offer. Insurers often try to resolve claims faster by offering an initial settlement offer. This is one of their strategies to minimize the injured victim's payout. The early offer to settle from the insurer is generally far less than the value you deserve. It can be tempting to accept the offer. This is especially so when facing higher medical costs and the pressure of recovery. However, you have to remain patient. Refrain from settling your insurance claim until you know its full value.

- Consult a truck accident attorney. Dealing with a trucking company’s insurer is not easy. The right lawyer, however, can make a significant difference. They can:

- Handle all the communications with the insurance provider on your behalf.

- Fight for your interests and rights, and

- Develop a compelling case to assist you in securing justice and maximum compensation.

Find a Skilled Truck Accident Attorney Near Me

If you or your loved one has been in an accident with a commercial truck, you want to contact an experienced truck accident attorney promptly. Commercial truck collisions are intricate cases. They involve complicated regulations, several insurance policies, and severe injuries. Working with a reliable legal team comes in handy. For one, you can concentrate on nursing your injuries while it handles the legal intricacies of your case.

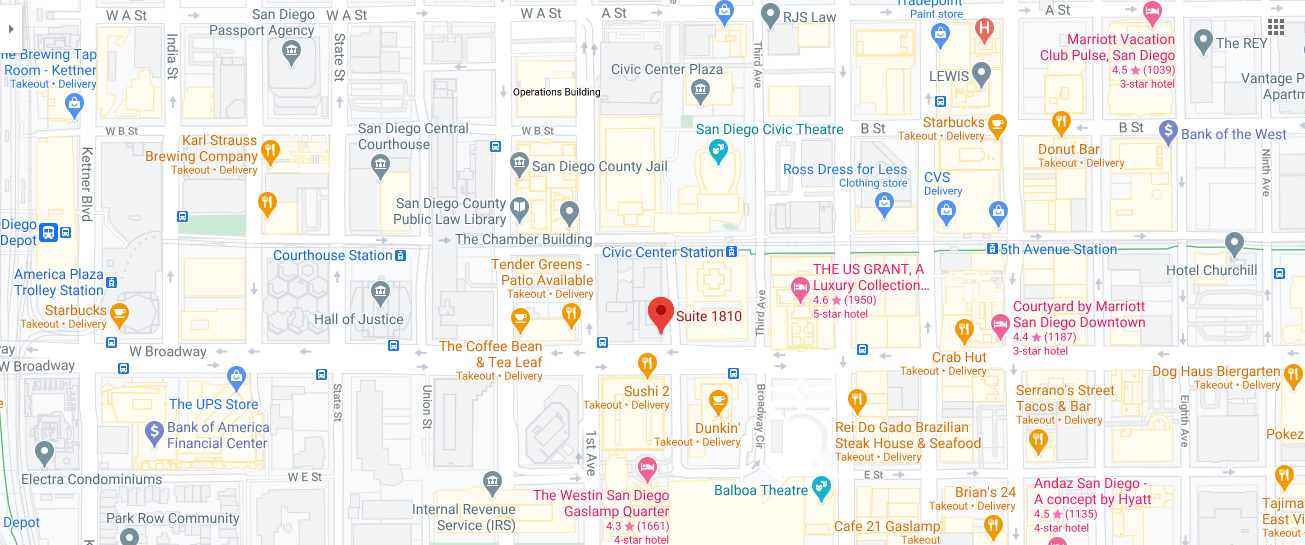

At Truck Accident Injury Attorney Law Firm, our lawyers specialize in assisting individuals hurt in commercial truck crashes throughout California. We guide them through insurance laws and pursue appropriate compensation for them. We can do the same for you or your loved one and will fight to recover the settlement you deserve. Contact us today at 888-511-3139 for a complimentary consultation to review your case and explore your legal options.