Large commercial vehicles, trucks included, are incredibly critical for the prosperity of our economy. These motor vehicles ensure goods are moved throughout the state and country. But accidents involving large trucks usually cause major property damage and significant injuries. Due to this, it is a requirement for commercial trucks to carry various types of insurance that are above and beyond what most motorists are mandated to purchase. Here, we examine commercial truck insurance requirements in California so you understand what coverage may be available if you are hurt in a truck accident.

What does Commercial Truck Accident Insurance Mean

California commercial trucking companies are susceptible to substantial risks, from multi-vehicle accident claims to cargo loss. Commercial truck insurance can protect these companies from most of the automobile-related dangers they face.

Commercial truck insurance is specialized auto insurance for commercially registered trucks. Whereas these policies resemble other vehicle insurance policies at several points, they usually have more optional coverages and higher limits.

Companies that Should Purchase Commercial Truck Insurance

Most companies in California with commercially registered trucks should purchase commercial truck insurance. Generally, state law requires that trucks driven on public roads be insured.

A wide array of companies have commercial trucks. These are just a few examples of the companies that might have to purchase commercial truck insurance:

- Contractors with commercial box pickups or trucks.

- Waste management and recycling businesses.

- Heavy equipment servicers and distributors.

- Local and long-distance moving companies.

- Last-mile and local delivery businesses.

- Regional freight and long-haul businesses.

Insurance Requirements for California Commercial Trucks

California has always supported its citizens; hence, it has firm insurance requirements for commercial truck drivers and trucking companies. California commercial truck insurance requirements vary based on the cargo transported. The requirements include the following:

Primary Liability Trucking Insurance Coverage

Whether you drive long-distance or locally in California, you must purchase liability insurance coverage. California law mandates truck drivers and trucking companies to carry minimum liability insurance, determined by what they transport and where they transport it. For example, all commercial truck drivers operating only within the state lines and driving vehicles that are over 10,000 GVW (gross vehicle weight) must obtain a California intrastate ID number and carry liability insurance based on the cargo:

- 20,000 dollars per motor vehicle and 20,000 dollars in cargo insurance per catastrophe.

- 300,000 dollars liability insurance cover for moving household goods.

- 750,000 dollars liability insurance coverage for carrying general freight.

- Five million dollars in liability insurance coverage for hauling hazardous materials.

- One million dollars in liability insurance coverage for moving oil.

What About Trucks Crossing State Lines?

Most commercial trucks transporting goods within California also transport goods across borders. And if a truck operates across states, the trucking company and the truck driver must also comply with the insurance requirements stipulated by the FMCSA (Federal Motor Carrier Safety Administration), at least if the company wants to acquire its MC number (operating authority number).

Truck liability insurance coverage is required for any interstate truck driver and trucking company since it protects them and other drivers if they are found responsible for a collision.

Like the requirements stipulated by California State, the FMCSA also sets forth bodily injury and property damage insurance requirements based on the kind of cargo being hauled:

- 10,000 dollars per incident for transporting household goods.

- Five thousand dollars per truck for transporting household goods.

- 750,000 dollars-five million dollars for vehicles above 10,000 pounds (these amounts are based on the kind of freight being carried.

- 300,000 dollars for vehicles below 10,000 pounds (transporting non-hazardous cargo).

Bodily injury liability is available, so the insurer pays for the medical expenses of anyone injured in a truck collision. On the contrary, property damage pays for anyone's property damaged in a collision.

Physical Damage Insurance Coverage

Unlike truck liability insurance coverage, physical damage insurance is not necessitated by law. Although, it is not less essential. Naturally, accidents that involve trucks escalate to being expensive quickly. Per the FMCSA, all larger truck accidents cost around 91,000 dollars per collision. This average increases to almost 200,000 dollars when an accident leads to injuries.

However, physical damage insurance coverage safeguards the trucking company from losses, particularly when the truck is financed or put out of commission. It protects a trailer or tractor from any collision on the roadway.

Bobtail Insurance

Owner-operators that have already purchased primary truck liability insurance are not mandated to carry bobtail insurance. But if they are leased to a motor carrier and operate under their authority, this insurance could be a requirement. Put otherwise; bobtail insurance is necessary when a truck does not have a trailer attached to it. That said, own-operators are eligible for this insurance if they satisfy any of these conditions:

- They are a truck driver driving a truck belonging to another party, and a trailer is not attached to the truck.

- Their motor carrier policies include purchasing insurance.

- They wish to safeguard themself from costly court settlements or any legal action if their truck is involved in accidents with other motor vehicles.

Bobtail insurance coverage applies to liabilities only. It protects its operators if its truck is involved in an accident and the carriage is in another person's ownership. The policy does not cover the physical damage to the truck. It covers other necessary costs, including medical expenses, legal fees, settlement matters, and injury claims.

Like most auto insurances, bobtail insurance also looks at the many factors contributing to the policy's average cost. When a truck driver purchases this policy, the insurer checks for details like the driver's driving history, prior on-record collisions, the limit the driver requested, and the number of times the truck will be on the road without a trailer. A driver who applies for a reasonable limit and has no prior collisions will purchase the policy at a lower rate.

On the contrary, a driver with an unclean record and many traffic violations on their license will trigger the price to go high, though the insurer is entitled to decline the request. Averagely, with all other requirements satisfied, a driver can purchase the insurance policy for 30 to 60 dollars per month, providing coverage up to 100,000 dollars.

Truckers General Liability Insurance

Trucker general liability insurance is a form of insurance coverage that can assist trucking companies in protecting themselves financially if they are ever held liable for causing injury or damaging another person's property. This insurance is essential since it can assist companies in paying for property damage or injuries that may occur due to company activities not directly related to driving a truck. It provides coverage for the following:

- Delivering cargo to the wrong place.

- Erroneous delivery of goods leading to damage.

- Customers slipping and falling on company premises.

- While unloading the truck, the company driver drops heavy equipment on a person, thus hurting them.

Most trucker general liability policies start at a limit of 300,000. However, common limits are one million dollars per occurrence with a two-million-dollar aggregate. Companies can obtain higher limits if necessary. Additionally, a company might have to add a pollution endorsement if it hauls particular hazardous material.

Do not confuse general liability coverage with primary liability trucking coverage. To purchase general liability, a trucking company must already have primary liability trucking insurance. Some truck insurers will also not cover companies transporting certain commodities, such as tobacco or hazardous goods.

Cargo Insurance Coverage

For-hire interstate truckers require cargo insurance coverage to secure their merchandise. This insurance is typically needed by the company or party that owns the hauled goods.

Usually, the insurance limit is 100,000 dollars, although the specific amount could vary based on the kind and value of commodities being transported. Additionally, the company or party may require specific endorsements based on the goods transported. For example, they will need to ensure they purchase reefer breakdown coverage if they are transporting refrigerated goods. This may cover a 50,000 dollars load of ice cream should the reefer unit break down in an accident.

Of the truck insurance policies, cargo insurance coverage is what trucking companies must pay attention to and understand the most. Usually, companies receive whatever they pay for, and some insurers will make several exclusions, particularly excluding coverage for given events.

Cargo insurance differs from general liability coverage that covers the trucking company if a person is hurt or their property damaged due to the company or party’s business. Cargo insurance covers the company if the cargo is stolen, lost, or damaged in an accident while in transit.

Occupational Accident Insurance Coverage

Most businesses in California that have workers are mandated to have workers' compensation insurance, which usually protects against workplace injuries. However, workers comp insurance does not usually protect independent contractors, which is where occupational accident insurance coverage comes in.

Occupational accident coverage may cover independent contractors’ workplace injuries. This coverage is available through commercial trucking insurance policies, and trucking companies working with owner-operators can purchase it.

Uninsured and Underinsured Motorist Coverage

California statute requires that truckers carry 15/30/5 in liability insurance. These numbers mean if the driver is liable for a collision, the insurance company will pay a maximum of:

- 15,000 dollars for death per party or bodily injury

- 30,000 dollars for total death per collision or bodily injury (to all individuals in the other auto combined)

- Five thousand dollars for any property damage (accident coverage) to other motor vehicles

Auto insurance in California is available at higher values than the 15/30/5 minimum insurance limits. For example, most insurers offer a maximum of 100,000 dollars per party and 300,000 dollars for total bodily harm per collision. However, most drivers are unwilling to pay or cannot afford the premiums for this insurance, which places the burden of covering medical costs and the losses after a truck accident on government programs like Medi-Cal and Medicare or private health insurance companies.

For the state to prevent this, the law mandates insurance companies to offer motorists coverage for collisions caused by uninsured truck drivers. This type of coverage is called UMC (uninsured motorist coverage). It comprises UMBI (uninsured motorist bodily injury) and UMPD (uninsured motorist property damage).

And even when truck drivers pay for insurance coverage, they usually opt for coverage at the minimum amount. The amounts are usually so low to compensate for damages for even minor accidents. They are especially insufficient in severe accident cases where multiple occupants are involved. Underinsured motorist coverage considers the other motorist uninsured for any damages worth beyond the responsible driver’s policy limit.

Non-Trucking Liability Insurance

Truck drivers do not only need insurance for when they are under dispatch. They also need coverage for non-duty truck operations. Non-trucking liability insurance provides them with this protection. This insurance coverage is specialized for when motorists operate trucks when not working. It provides protection anytime a driver uses a truck for their use.

Generally, California truck drivers are mandated to have this kind of insurance anytime they drive a commercially-registered truck for use outside of their official duties. An employer or owner-operator pays for this coverage. This insurance can apply to commercially registered trucks. Coverage is usually purchased for non-dispatched truck trailers, although it could also be purchased for cargo vans and tow or straight trucks.

The protections this type of insurance gives are often defined as numerous sub-coverages within a wider coverage. Some of the sub-coverages frequently offered are:

- Underinsured/ uninsured motorist coverage— covers accidents with uninsured motorists

- Medical payments coverage— covers motorist and passenger’s medical costs

- Protection for personal injury— covers injuries upon the truck driver plus their passengers

- Property damage liability coverage— covers damage to other’s property, like vehicles

- Third-party bodily injury coverage— covers injuries inflicted on other people

When contained under non-trucking liability insurance, all these sub-coverages usually only apply if the insured truck is operated for personal use. These sub-coverages are also frequently offered distinctly when the driver drives the truck for work purposes, but the terms differ when the protection is applied to personal use and not work.

Note that non-trucking liability insurance primarily covers damage or injuries affecting others. It does not necessarily protect the truck itself against damage.

The insured truck, truck’s main location, driver’s record, estimated non-work mileage, and other factors affect how much this type of insurance costs. Irrespective of the amount charged for non-truck-liability insurance, the premiums are generally folded into commercial truck insurance policy premiums. This form of insurance is rarely billed distinctly from a broader policy.

Commercial Trucking Insurance Policy Premiums

Since commercial trucking insurance policies cover different types of trucks and different uses, premiums for these insurance policies vary significantly. Some insurance policies for small pickup trucks driven within the state may be affordable, whereas policies covering hazmat trucks crossing the border can be more substantial.

The various details that often affect policy premiums include:

- How many trucks are being insured

- Places that trucks go into, for example, hard hat places

- States and regions that trucks are driven in

- Types of freight that trucks carry

- Driver's recent accident histories and driving records

- Drivers' endorsements and classes

- Annual mileage that trucks travel

- Model, make, and year of trucks

How Insurance Minimums Impact Accident Victims

Any large commercial truck accident could lead to property damage and severe injuries for the involved parties. This is especially the case for the parties in the traditional passenger autos. The minimum insurance liabilities described above aim to assist in compensating property damage or injury victim if the accident results from the trucking company or truck driver’s negligence,

Although, it is not unusual for these minimum insurance liabilities to fail to provide sufficient coverage, especially if the injuries sustained are catastrophic. Therefore, if you are a truck accident victim, you should work with an experienced truck accident personal injury lawyer who can address all the aspects surrounding the investigation.

A lawyer will be involved immediately and do a comprehensive investigation into the matter, including collecting the evidence required to show fault, looking for other liable parties, and handling any negotiation with the legal teams and insurance carriers involved. Eventually, the objective is for accident truck victims to recover damages for all their lost income, emergency medical costs, follow-up treatment expenses, property damage costs, and damages for pain and suffering.

Find an Experienced Personal Injury Attorney Near Me

You deserve compensation if you have been involved in a commercial truck accident that was not your fault and you sustained injuries or suffered property damage. This is one of the primary reasons why trucking companies and truck drivers must purchase insurance. If a trucking company (whether big or small) or truck driver is responsible for an accident you were involved in, their insurance helps pay for any losses incurred. Therefore, do not hesitate to contact a personal injury lawyer for help.

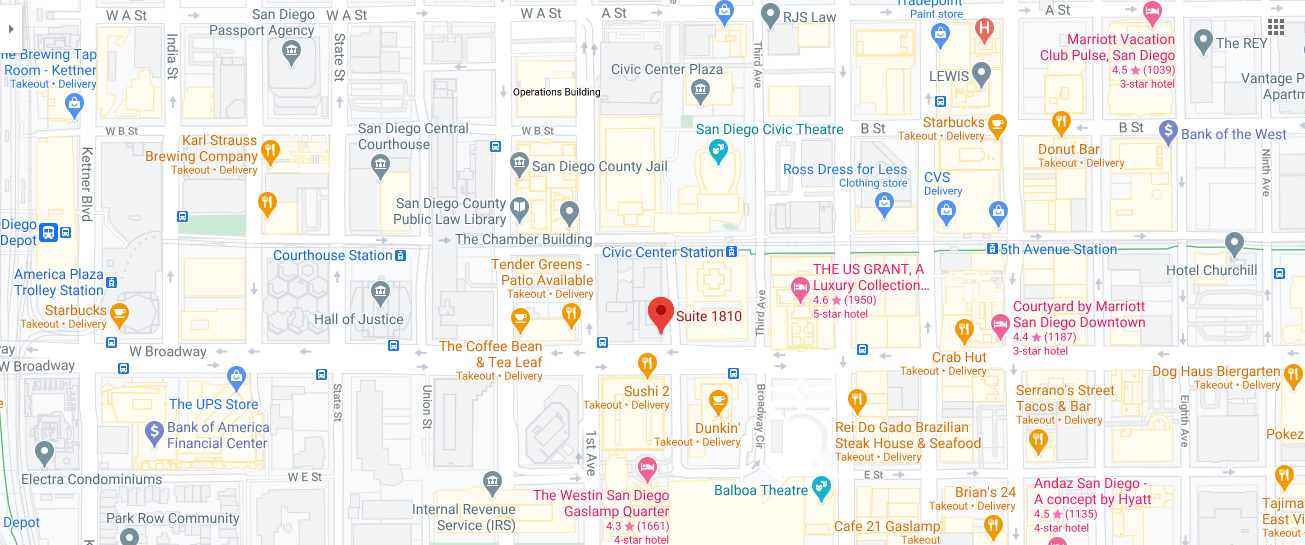

At Truck Accident Injury Attorney Law Firm, we help clients throughout California with personal injury cases related to truck accidents. We will explain any insurance information for which you need clarification. Also, we are readily available to help you negotiate with insurance companies so you can recover all the damages you deserve, including property damage, medical bills, pain & suffering, and lost wages. Call us for a consultation at 619-754-7667 if you believe you have a case.